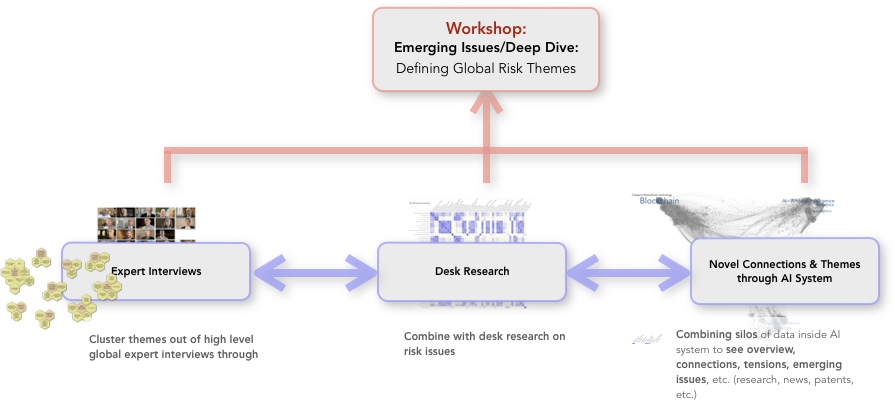

Our Process:

Below an overview of the process of delivering the Risk Radar Report & Asset Allocation Strategies

Identification of Issues:

We use the analytical framework of scenario thinking to look at the world. This combines:

- What have we missed? Inductive exploration: What are the emergent issues?

- What has changed? Deductive exploration: How have the known unknown issues changed in veracity, in centrality, in sentiment, etc. Is there a shift happening that we do not (yet) know about?

As input to the yearly workshop we combine the insights from the analytical platform Erasmus.io to identify emerging issues; with high level global interviews and old fashioned desk research. These are not done in a linear fashion but feed into each other. An insight from an interview might be further explored on the AI platform and vice-versa. At the end of this process we have identified a set of global themes which we discuss together in a workshop or a call, additional bespoke client themes are added and we monitor these using the Erasmus.io platform.

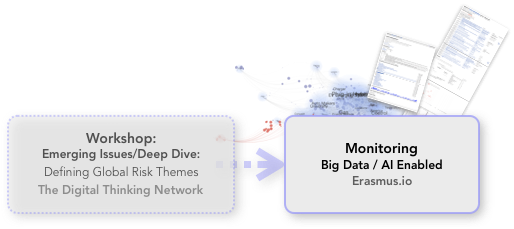

Monitoring:

Automating the monitoring process: The Erasmus.io platform reads 100Ms URLs every hour to add to its corpora of billions of articles. This includes news sites, blogs, research reports that might not be mentioned in the news, and it is then complimented with patents, SEC filings, Earning Calls, open access academia, medicine, clinical trials, etc.

All these sources are matched against complex models of our issues- combining human and machine curation to create overview, textual analysis, sentiment, etc. and recommending specific articles.

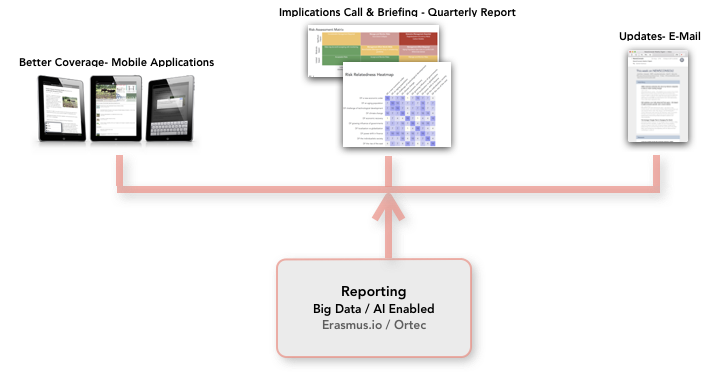

Reporting

A quarterly report generated using the Erasmus.io/ NEWSCONSOLE analytical platform, combining AI at the scale of billions of articles with expert human curation, translated into interim implications for portfolios by Ortec Finance.

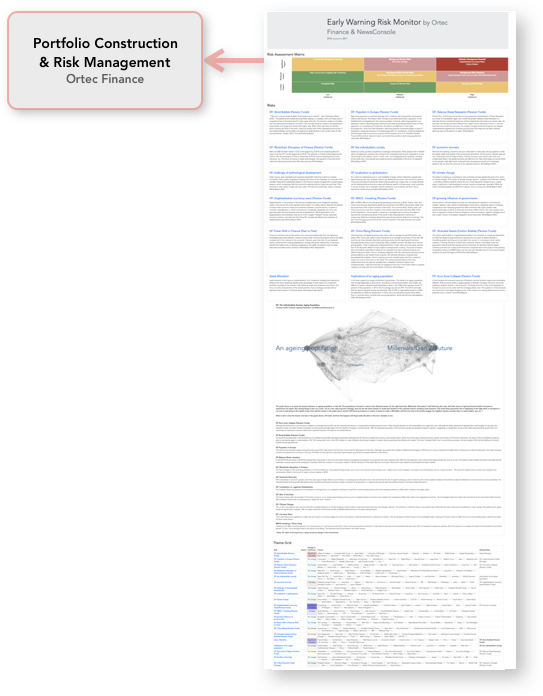

Portfolio Construction & Proactive Risk Management

The big data insights translated to proactive portfolio actions. Ortec Finance translates these long term and tactical insights into portfolio implications both in a report and in an interactive WebCast/ meeting. This allows the fund to see over the horizon, to identify risk before they happen, anticipate the unthinkable and be ready for change rather than being surprised by it.

Secondly we share risk insights across the pension fund industry (if requested), to help pension funds to learn better from each other.