Risk Radar Reports

Every Year:

Every year we hold a workshop (or a webcast) to define the key themes that we shall be tracking. As input to these workshops we share deep interviews with a set of remarkable people. (see interview section)

Additionally every year we generate an overview report that brings together all the insights with a longer term view. These reports can be used as key input to investment boards, and risk submissions to Central Banks.

Every Quarter:

Every quarter we generate a Risk Radar Report that we mail through to our clients. The report gives an overview to our risk themes, with an assessment matrix that defines appropriate management actions relating to the risks and opportunities. In addition we also table:

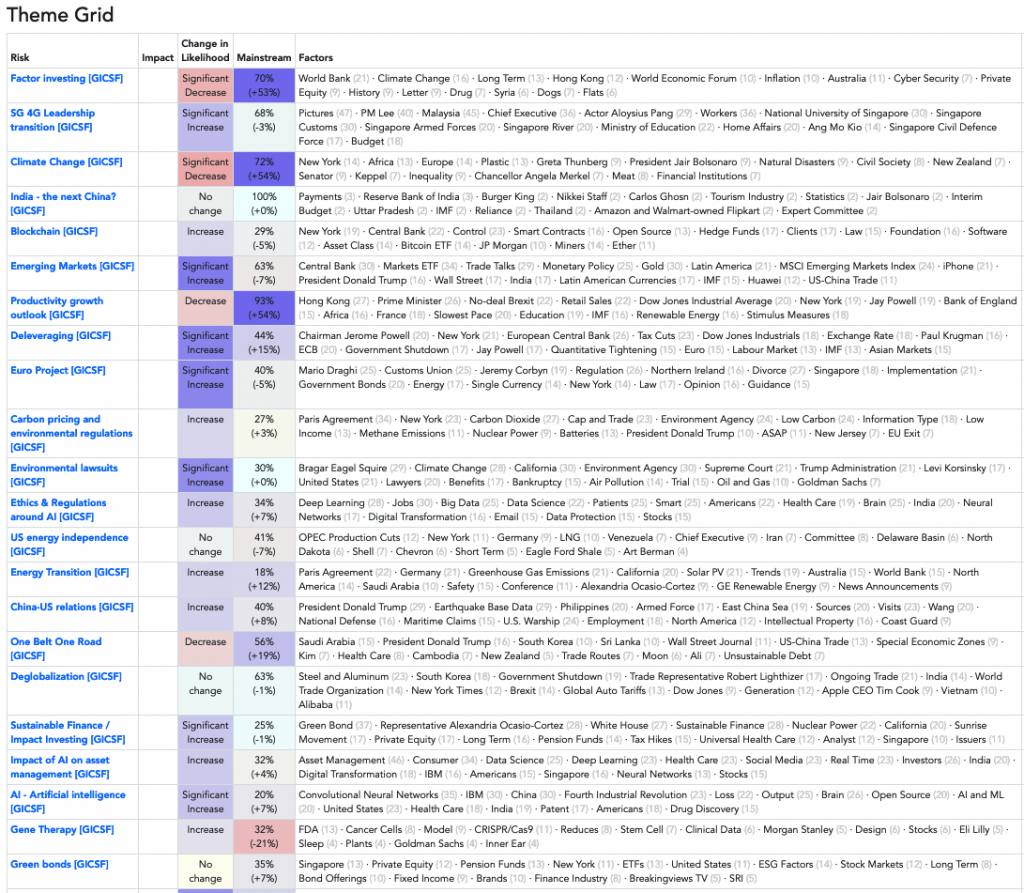

- Sentiment – to see shifts in sentiment across the themes

- Momentum– to see hidden movement in issues that have not been picked up by the (financial) press

- Edginess– to see how issues emerge

- Core Concepts– to gain overview of the key issues at play

- Relatedness– to show how themes relate to each other (often creating surprising connections)

- etc.

Each of the themes are translated to implications for asset allocation strategies and portfolio creation as well as a description of a knowledge graph and key articles. Every quarter we have a webcast to discuss the results of the report and appropriate shifts in asset allocation strategies.

Every Week/ Day

Every week we mail a short overview of relevant articles (if the client chooses) and enable bespoke access to iPhone/ Android App that gives overview of key articles, and access to a risk radar community that shares the learning throughout the platform.